Chapter 2 Banking Legislation and Regulation. Add 4 to 983.

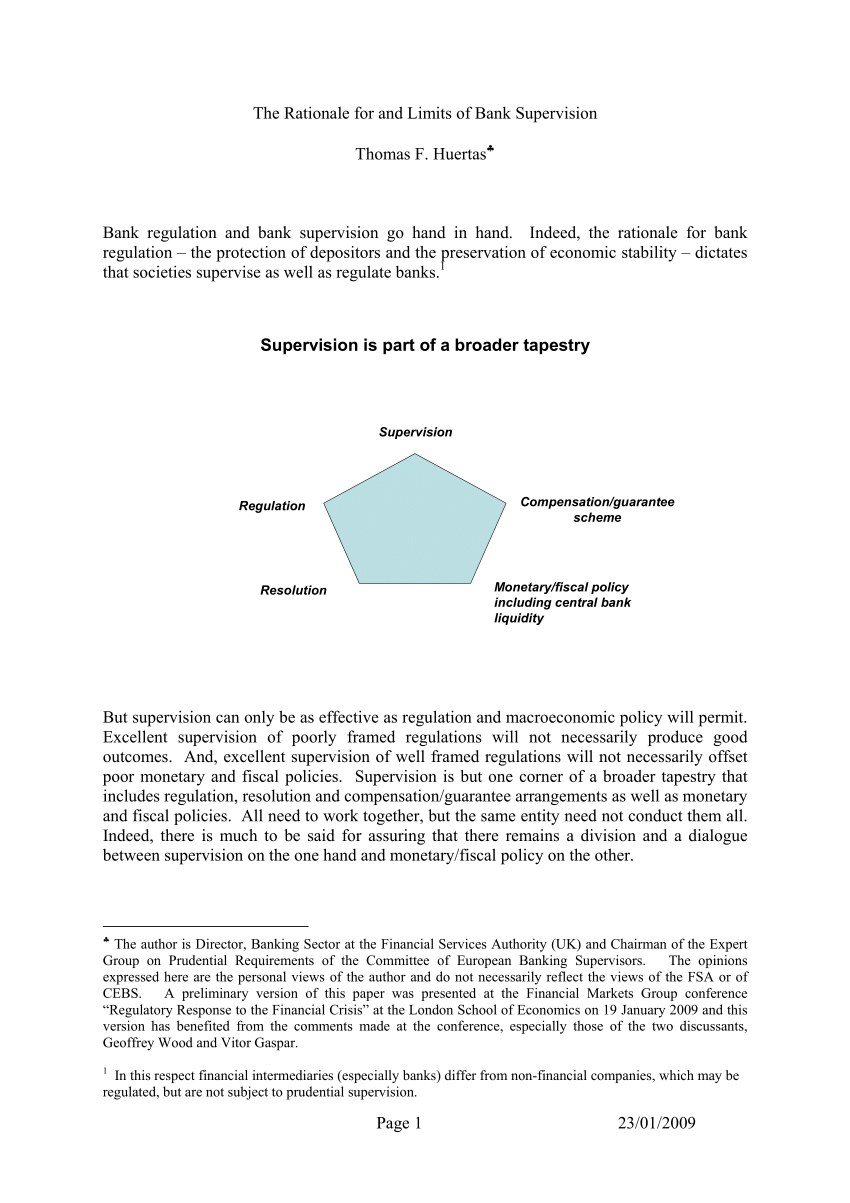

Pdf The Rationale For And Limits Of Bank Supervision

The GarnŒSt Germain Depository Institutions Act of 1982 GarnŒSt Germain.

. Also known as the Glass-Steagall Act. The Competitive Equality Banking Act of 1987 CEBA. Regulation BB This regulation implements the Community Reinvestment Act.

Ethical Issues for Bankers. Essentials of Workplace Conduct. Defines unfair or deceptive acts or practices of banks in connection with extensions of credit to consumers.

4 Bank governance and internal controls. Prohibits certain practices such as taking a non-purchase money security interest in household goods. Bank regulation is designed to address several issues.

Banking Act of 1933 PL. The Civil War that erupted during 1860s was a major crisis and created great demands for funds by the government to finance the war against the Southern states. Banks control the money supply itself and the government may institute policies to expand or contract it but its banks that are the engine behind the money supply.

Bank regulation is intended to maintain the solvency of banks by avoiding excessive risk. Unfair discriminatory or fraudulent practices. Bank regulation after its initial entry into chartering banks in the early 1800s.

Adverse selection can be a factor in this contraction. Another part of bank regulation is restrictions on the types of investments banks are allowed to make. Banks also have to hold cash or assets that can be sold very quickly to cover unexpected withdrawals.

Banks are permitted to make loans to businesses individuals and other banks. Without banks the money supply would simply dry up. Regulation of financial institutions has evolved over the last century primarily in response to scandal and crisis but also in response to both domestic and international.

Add your answer and earn points. That law is the Dodd-Frank Act the Act. Some banks go bankrupt.

Laws Regulations Overview. In October 2008 a divided Congress passed the Emergency Economic Stabilization Act which provided the Treasury with approximately 700 billion to purchase troubled assets mostly bank shares. Regulation requires that banks maintain a minimum net worth usually expressed as a percent of their assets to protect their depositors and other creditors.

3 Recent regulatory themes and key regulatory developments. Federal legislation that gave individual states the authority to govern bank branches located within the state. Fundamentals of Small Business Banking.

Consequently the National Currency and Bank Acts of 1863 and 1864 provided the impetus for a federal system. As regulation focusing on key factors in the financial markets it forms one of the three. The banking sector contracts.

The OCC is the primary regulator of banks chartered under the National Bank Act 12 USC 1 et seq and federal savings associations chartered under the Home Owners Loan Act of 1933 12 USC 1461 et seq. Many people do not properly understand this and think that the money supply is how much money that the government prints but. Regulation is used to make it less likely people will take out their money unexpectedly.

The Financial Institutions Reform Recovery and Enforcement Act of 1989 FIRREA. Regulation falls into a number of categories including reserve requirements capital requirements and restrictions on the types of investments banks may make. Banking Acts of 1933 Glass-Steagall and 1935 Created the FDIC Separated commercial banking from the securities industry Prohibited interest on checkable deposits and restricted such deposits to commercial banks Put interest-rate ceilings on other depositsdeposits to commercial banks Put interest-rate ceilings on other deposits.

The act was intended to allow national banks to compete with state banks by permitting them to open branches within state limitations. Depositors ability to recover their funds. The Reason for Dodd-Frank Major goals of the Act included.

Regulation AA establishes consumer complaint procedures. Also known as The McFadden Act of 1927. In a sudden crisis the balance sheet of a firm can change quickly.

In July 2013 the US federal bank regulators adopted final capital regulations implementing the Basel III capital framework established by the Basel Committee on Banking Supervision. Bank loans and investments decline and the money supply falls. This includes branches of national banks located within state lines.

Describe legislation passed to regulate banks 1 See answer Advertisement Advertisement demariow74 is waiting for your help. Money and Banking Bank Regulation Bank Crisis The reverse happens in a bank crisis. Billed as significant regulatory relief for banks by someand not enough regulatory relief by othersthe new law calibrates a massive piece of banking legislation enacted after the 2007-08 financial crisis.

The FDIC is an independent agency that was created after Congress enacted the Banking Act of 1933. Banking Regulation 2022 covers subjects including. In the United States through much of the 20th century a combination of federal and state regulations such as the Banking Act of 1933 also known as the Glass-Steagall Act prohibited interstate banking prevented banks from trading in securities and insurance and established the Federal Deposit Insurance Corporation FDIC.

Bank regulation is a form of government regulation which subjects banks to certain requirements restrictions and guidelines designed to create market transparency between banking institutions and the individuals and corporations with whom they conduct business among other things. An Act to Amend the National Banking Laws and the Federal Reserve Act PL. Dealing Effectively with Co-Workers.

1These five laws were the Depository Institutions Deregulation and Monetary Control Act of 1980 DIDMCA. Established the Federal Reserve System as the central banking system of the US. Discrimination based on marital status.

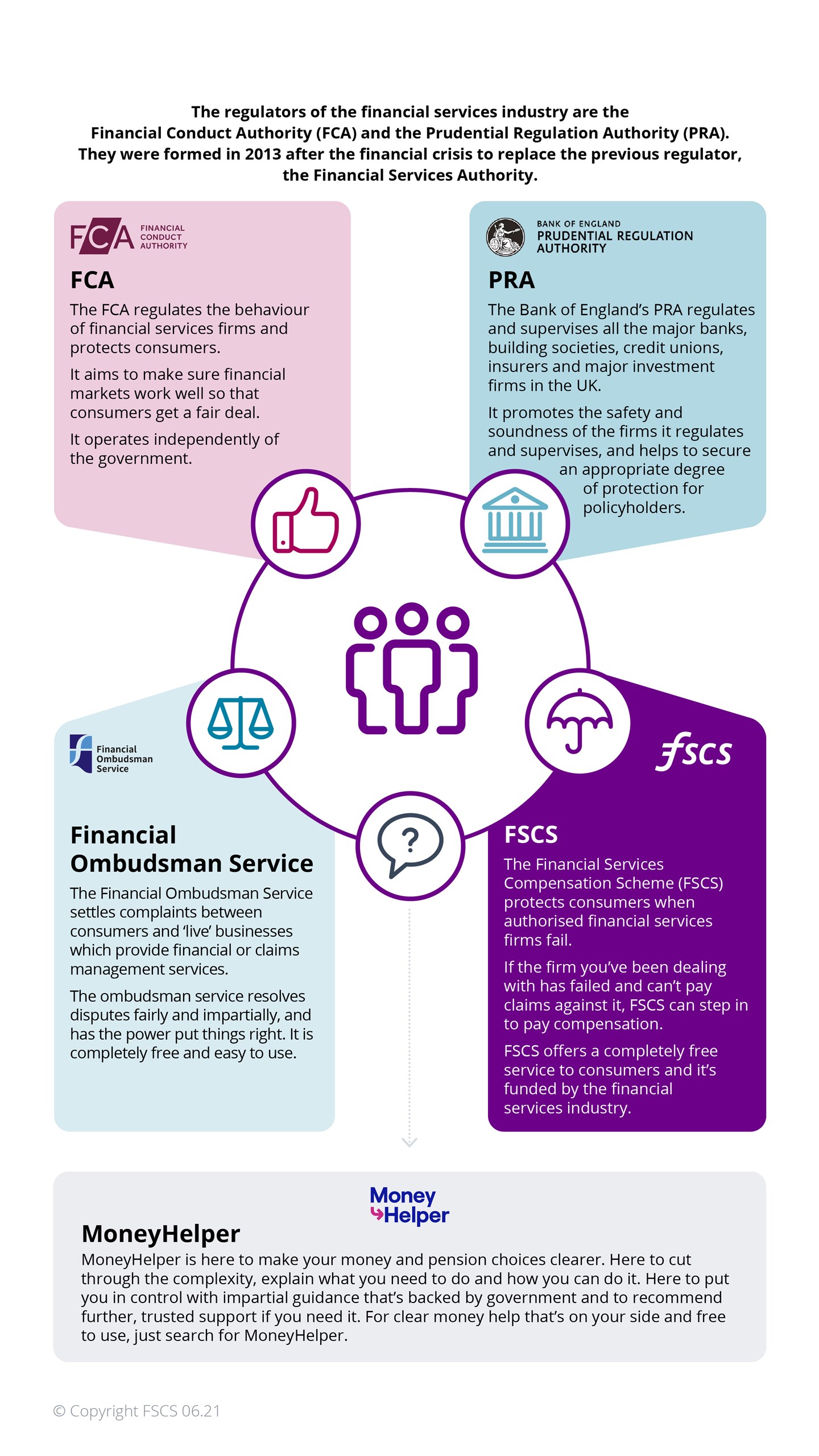

Overview of banking regulators and key regulations. The OCCs regulations derived from these acts are in title 12 of the Code of Federal Regulations Banks and. The Equal Credit Opportunity Act ECOA of 1974 implemented by Regulation B requires creditors which regularly extend credit to customersincluding banks retailers finance companies and bank-card companiesto evaluate candidates on creditworthiness alone rather than other factors such as race color religion national origin or sex.

The most well known regulatory banking and financial authority is the Federal Deposit Insurance Corporation or FDIC. There is a deposit guarantee scheme that ensures that even if a bank fails all deposits under 85000 will be protected. 5 Bank capital requirements.

Who Regulates Whom An Overview Of The U S Financial Regulatory Framework Everycrsreport Com

0 Comments